Week ended July 28, 2023, interesting news items to look at this week were:

1. Spycraft: The removal of China FM Qin Gang from Office has generated tremendous speculation among both local and international media. (Fig. 1)

Whilst the author has no inside knowledge about the circumstances regarding Qin’s removal, the notable official pronouncements were: (i) Qin retained his position as a State Councilor, and (ii) the Official reasons given for his removal was his bodily conditions. Remarkably the incident came right on the heels of Russia’s Prigozhin’s exiled to Belarus. I am not saying the two incidents were somehow linked but there must be more that meets the eyes. Was Prigozhin truly exiled or was he redeployed to Belarus in order that the Wagner troops may be stationed much closer to Kiev. Was Qin Gang removed or redeployed?

One thing I learn from history, is whatever BBC says, it is usually the opposite. From what little I understand about spycraft between US and China. The US has teams of people, whether CIA or US Embassies abroad, out to acquire intelligent assets continuously. Equally China has teams of people in counter-intelligence out to profile international scholars and students that may be entrapped and betray China. So the tabloid type of news that Qin fell into a honey trap or withheld info on treasonous acts by descendants of top PLA Generals are just that, tabloid speculations. Remember ex Secretary of State, Hillary Clinton. Has anyone got to the bottom of Hillary Clinton’s State Departments email in Hillary’s home server and her “Play for Pay” Scandals . (Fig. 2)

Episodes as such will continue to surface and truth will unlikely be revealed until may be half a century later. Corrupt officials from both sides of the Pacific are par for the course but at these sensitive times, let us not lend our ears to juicy but unfounded tidbits.

2. Inflation to Raise its Head Again this Winter: IMF predicts the suspension of the Black Sea Grain Deal could raise prices by 10-15%. (Fig. 3).

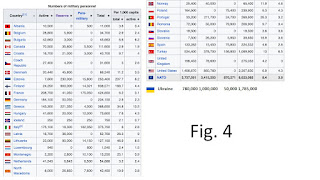

Concurrently, India is also to restrict rice exports adding further pressure to the global food supply chain. (Fig. 3 Red Framed Insert). Another Black Swan on the inflation front was the very mild winter in Europe in 2022 which mitigated the energy crisis arising from the Ukrainian war. However, as its typical in global weather pattern, the reversion to mean factor would mean winter in Europe should be colder than usual in 2023. This should give rise to another sharp spike in energy prices. Core inflation rates (everything else other than energy and food) may have been tamed by demand destruction through credit squeeze by Central Banks but to the majority at large, livelihood is all about food and energy. Finally the big ugly gray rhino staring right at us is the escalation of supply chokeholds between US and China. The export control of rare earth minerals by China is strategically timed to impact the West in queue right after food and energy inflation take their first bite. Be warned my friends, it is a time to exercise caution as the clueless western momentum traders are all piling in out of FOMO in one final blaze into oblivion. (Fig. 4)

This week’s financial markets:

A. Stock Market: (Fig. 5): Dow closed at 35,459 for the week, a gain of 232 points or 0.65%. S&P +0.85% and NASDAQ +1.67%.

The Fed 25 basis points rate hike has already been priced in and the market celebrated that this may be the end of the rate increase cycle. As explained in the previous week, the 7 AI hyped stocks led the charge with the exception of Microsoft on account of its disappointment of its Azure Cloud growth. In a major move to stimulate the Chinese economy, the Central Government has moved to further relax credits and the long depressed property and tech sector took the cue. The Chinese stock indexes rebounded by over 3%.

B. Debt Market: (Fig. 6): USGG10YR ended the week at 3.957%, an increase of 12 basis points, less than half the Fed Funds hike of 25 basis points.

Spread between YR2 and FFR widened again, signaling the financial market is not in total agreement with Fed’s Policy (Fig. 7).

As mentioned last week, the Fed has but an Hobson’s choice of saving the US$ or US economy and the growing divergence means the Fed will save neither. The UST Yield Curve continued to exhibit the steepest inversion since the default of Bretton Woods in the 70’s as the same crisis again came on stage. (Fig. 8).

Since the Ukraine War and piracy of Russian Government and Citizenry Assets, global de-dollarization has been on a rampage. (Fig. 9) shows the individual countries tha have sold down US Treasuries.

The Western alliance Central Banks have already massage the relevant numbers through synthetic purchases using Foreign Reverse Repos, particularly BOE and the Fed, otherwise it would have shown there is virtually no international demand at all. (Fig. 10).

The question remains as how much time remains before the domestic US money and banking market morphed into a Zimbabwean Hellhole. One 75 year old military and financial veteran suggested a tectonic shakeup should start in the second week of September 2023. I have marked my calender for Friday September 15 2023.

C. FX and Commodities and Precious Metals: (Fig. 11)

Trading results for the week: Oil (+5.22%), NASDAQ (+1.67%), S&P 500 (+0.74%), Rmb(+0.55%), JPY(+0.37%), GBP(-0.01%), Gold(-0.08%), Euro(-0.95%), Silver(-1.18%), Rubble(-1.71%), Bitcoin(-1.83%). Knowing the manipulations involve, I treat the weekly volatility as just background noises unless accompanied by unexpected disruptive breaking news.

Psams 37:7 Rest in the LORD, and wait patiently for Him; Do not fret because of him who prospers in his way, Because of the man who brings wicked schemes to pass. 8 Cease from anger, and forsake wrath; Do not fret—it only causes harm. 9 For evildoers shall be cut off; But those who wait on the LORD, They shall inherit the earth. 10 For yet a little while and the wicked shall be no more; Indeed, you will look carefully for his place, But it shall be no more. 11 But the meek shall inherit the earth, And shall delight themselves in the abundance of peace. 12 The wicked plots against the just, And gnashes at him with his teeth. 13 The Lord laughs at him, For He sees that his day is coming. 14 The wicked have drawn the sword And have bent their bow, To cast down the poor and needy, To slay those who are of upright conduct. 15 Their sword shall enter their own heart, And their bows shall be broken. 16 A little that a righteous man has Is better than the riches of many wicked. 17 For the arms of the wicked shall be broken, But the LORD upholds the righteous. 18 The LORD knows the days of the upright, And their inheritance shall be forever.