October 7, 2022 key news items this week:

1. Energy War: Henry Kissinger said:”Control oil and you control nations; control food and you control people” (Fig. 1).

For the United States, control of energy production and energy transit choke points on a global scale has been her most important geopolitical policy since the WWII. Henry Kissinger, the architect of the petrol dollar and dollar hegemony, certainly knows the subject inside out. Over the past 20 years, numerous wars were raged to preserve US “rules based international order” and her reign over many nations through the competition over control of energy.

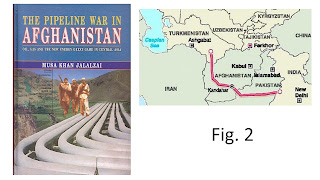

(i) Pipeline and Pipeline Wars: The Afghanistan invasion by US was in no small part about a pipeline to supply gas from Turkmenistan through Afghanistan to Pakistan and India by US sponsored Unocal. (Fig. 2)

The first US puppet president to Afghanistan, Hamid Karzai was an adviser to Unocal before being appointed by President Bush as Special Envoy to Afghanistan. The essence of the Syrian war was President Assad’s rejection of a US backed Qatar-Turkey pipeline through Syria to Europe in favour of Iran-Iraq Syria pipeline (Fig. 3).

The position of US against Nord Stream I & II from Russia to Germany needs no further explanation. US has lost her pipe dreams in Afghanistan and Syria and although her recent circumstantial sabotage of Nord Stream pipelines seems to be successful, the jury is still out as to the eventual outcome of the Russian Euro gas nexus. A new twist surfaced recently because of the redundancy factors built in by Russia in the Nord Stream designs.

(ii) Nord Stream II String B : In a rarely reported announcement, Russian gas supplier Gazprom announced one of the parallel lines of Nord Stream II was not damaged and gas supply may be resumed (Fig. 4).

Apparently the sabotage only involved Nord Stream I and String A of Nord Stream II. String B was a safety feature embedded in the original design so it wasn’t a secret. The interesting part was String B wasn’t damaged was kept hush hush for over a week by all those in the know (namely Russia, Germany, Netherlands, Denmark, Finland, and France) and in the meantime real emotions of the stakeholders were allowed their full expression. There was Blinken’s jubilation for an opportunity for US to step in and corner gas supply to Europe (Fig. 5).

In contrast, there were angry German public expression to lift Russian sanctions and stop military aid to Ukraine. Robert Habeck (Vice Chancellor of Germany) accused US of charging Moon Prices and Profiteering from Germany’s natural gas crisis (Fig. 6)

. Let’s see if this time round, the pain suffered by Europeans in the hands of the globalists would be enough as a wake up call to realize who the real villain is.

(iii) OPEC + doesn’t care what US wants anymore: OPEC humiliates Biden on a Global Stage by cutting production to lift oil prices when Biden specifically asked Saudi to increase production. (Fig. 7).

We reported Saudi had previously warned US not to play silly derivatives games to drive down future oil contract prices because the physical market is not in the West’s control anymore. For years it was the tail that wags the dog but watch out from Q4 2022, it is the dog that wags its tail. The spell casting smoke screens and mirrors through financialization of everything is loosing its potency. This will eventually break the dollar hegemony leaving US with only a military option. (Fig. 8)

2. Currency War: Last week I reported the US Treasury and the Fed is running out places to hide its true state of debilitated finances. This week BofA warns the Fed to slow or risks Breaking the Corporate Bond Market. It is echoed by Porter and Company that American Corporate Debt Bubble is about to Burst. (Fig. 9).

Last week I also reported the entire US Banks are net short of US Treasuries and a Bloomberg news clip this week just confirmed JP Morgan is still net short of US Treasuries on Oct 5th 2022 (Fig. 10).

DXY reached its peak round end of September and this prediction still holds. Please follow through with my report in the later paragraphs for updates. In the meantime, commodities (see OPEC in preceding paragraph) and goods suppliers (China) are keeping up the pressure on US prices thus giving the Fed no room to maneuver in this game of chicken.

3. Russian/Anglo American War in Ukraine: There is much hype in Western MSM about Ukraine winning in her counter offensive. In real battle logistics, Ukraine and Russia just have different trade offs. Ukraine is throwing everything in, man, equipment, arms and munitions with 300,000 men on the 1,000 Km border front line between the 4 new Russian annexed Oblast. This contrast with 200,000 RAF. So the Russians are now just focusing on taking out Ukrainian soldiers, arms and equipment in large numbers and retreat to minimize casualties. (Fig. 11).

Independent military analysts Scott Ritter fears Ukraine has little defense left in key target areas like Odessa, Mykolaiv and Kiev (Fig. 12)

and arms supplied by US and NATO is far below Ukraine’s consumption and destruction rates. Another analysts Brian Berletic calculated there were 22 Security Aide packages given by US to Ukraine (roughly 2 packages per month) and the quantities are on a decreasing trend. (Fig.13)

. Given the Europeans have already exhausted their old weapons stockpile to Ukraine and the US is bumping against the ceiling on what they can give, Brian concluded the counter offensive is not sustainable by pure logistics consideration. No wonder US and UK is stepping up the rhetoric that Putin will use tactical nukes to give US/UK an excuse for a preemptive nuclear strike against Russia or at least a decapitate blow on Putin (Fig. 14).

The past week’s financial markets:

A. Stock Market: Dow rose 571.28 points for the week (+1.99%) (Fig. 15).

There was excitement earlier in the week for the Federal Reserve to pivot on BOJ, BOE, RBA and Peoples Bank to either slow down interest rate advances or intervention on the Bond and Currency Markets in favour of stability. The intraweek DJI peaked at 30,455. This optimism fizzled out after OPEC+ announced cuts in production to strengthen oil prices. Stronger employment stats announced late in the week reinforced the market sentiment that the Fed may not pivot so early and DJI ended at 29,297 (a thousand points lower than the midweek high).

B. Debt Market: (Fig. 16):

USGG10YR ended the week at 3.888% an increase of 6 basis points or +1.54% change from the previous week. One of Wall Street most respected Guru on interest rates , Mark Cabana, sums up the drying up of demand on UST as: “Who will buy the bonds?” Our prior work suggests asset managers must step in to offset lack of UST buying from banks / foreigners / Fed. Asset manager UST risk taking willingness is limited; they know central bankers want rates higher & won’t fight the Fed. This backdrop supports limited demand & creates potential for rates to re-price higher. Limited risk taking & UST demand vacuum resulted in a deterioration of rates liquidity. UST order book depth has dried up notably: depth in 2y notes are at March ‘20 lows, 5y+ tenors are not far from it. Realized & implied volatility is at post GFC highs. (Fig. 17)

. This week’s UST Yield Curve saw short dates (1-12 months) moved up by over 12 to 24 basis points, being spooked by OPEC but long bond rates moved up by 5 to 7 points (fig. 18).

C. FX Market (Fig.19)

: for the week ended October 7, 2022, DXY opened at 113.023 and closed at 112.474 (Up +0.49%). Once European citizens are in riots over US war mongering in Ukraine, major Central Banks like JCB, BOE, RBA and People’s Bank started to intervene and says enough is enough, posturing of US interest rates will bite more into US domestic economy and Wall Street than enticing capital flow into America. I am holding DXY has peaked at the end of Q3 2022 unchanged. A close of DXY below 110 will start a cascading waterfall drop.

D. Precious Metals & Crypto :(Fig. 20)

Gold price opened at $1660.7, and closed the week at $1693.7, a gain of $33 (+1.98%). Early in the week we saw CTA has mostly covered their short positions n gold up to Tuesday 4th October. Central Banks have continued to absorbed whatever physical bullion that is available in the market and other strong hands took delivery in record quantities from Comex. The conclusion of most Gold Investors is that the days of derivatives driving commodity prices are numbered. Similar to Gold, CTA has covered their short position early in the week and price rose by close to 10%, then drifted lower following the stock market and closed the week up about 6%. The volatility in silver was in one aspect affected by the stock market as some retail stock traders use silver contract as an indirect hedge to offset stock price decline. They prefer to short silver rather than sell their Tesla or Apple stocks. Bitcoin ended the week up 0.75%. (Fig. 21)

Luke 14:28 For which of you, intending to build a tower, does not sit down first and count the cost, whether he has enough to finish it— 29 lest, after he has laid the foundation, and is not able to finish, all who see it begin to mock him, 30 saying, 'This man began to build and was not able to finish.' 31 Or what king, going to make war against another king, does not sit down first and consider whether he is able with ten thousand to meet him who comes against him with twenty thousand? 32 Or else, while the other is still a great way off, he sends a delegation and asks conditions of peace.33 So likewise, whoever of you does not forsake all that he has cannot be My disciple.

No comments:

Post a Comment