Week ended February 17, 2023. interesting news items to look at this week were:

1. Calling Out the Naked Emperor: Last week I wrote about Real GDP and its relationship to the Stock Market. Throughout this week, I felt it is a crucial time to address the intricacies of currency creation, stock prices and the physical economy. In particular the financial markets of the West, including Japan and China as I sensed something unpleasant is brewing in the horizon. Some of the readers of this Blog are seasoned bankers and investment bankers and others are respected professionals in their chosen field, so I hope the following discussion may invite their comments for my own education as this topic is rarely discussed in details.

(i) Prices and Market Valuation: The financial market and the real estate market has a unique characteristic in the sense that the entire market is valued on the basis of daily transaction prices. I value my apartment in Hong Kong or my house in Brisbane at a certain figure by mirroring some recent transactions in the same block or in the same street. In 2023, the average daily transactions of properties in Hong Kong was only 159 units and from that most people determine the value of the entire 1.7 million property units in Hong Kong on that basis. Daily transactions that only represented 0.009% of the entire inventory. In fact it was reported in the financial press yesterday, Hong Kong properties has lost $2.6 trillion in value over the past 2 years. (Fig. 1).

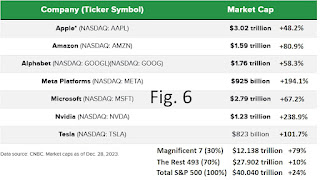

This valuation concept is even more prevalent in financial markets as stocks, bonds, commodities to cryptocurrencies used the same method. On similar basis, the Magnificent 7 Tech Stocks (Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla) has combined added US$ 5.25 trillion to the “wealth” of the US since the inception of ChatGPT on November 30, 2022. This increase in “value” in just over 15 months is larger than the GDP of Japan or Germany and by this 7 stocks, it would rank third in terms of value just behind US and China annual GDP. It doesn’t matter what “real” value added has actually been generated within the intervening period as all it takes was an average of 0.7% daily transactions to the total number of shares in issue to generate this new found wealth. (Fig. 2).

Away from the limelight, the Russell 2000 index (represent mid to small cap stocks) and the other 493 stocks within the S&P 500 languished with difficult business environment. In a nation of get rich quick momentum traders, ETF which skewed towards allocation to large cap stocks, algo driven high frequency trading and unstoppable debt/currency increase, this illusory wealth creation is not at all difficult to achieve.

(ii) The Driver and Achilles heel of the Dollar Hegemony: The rise of the dollar as a global reserve currency came in 3 stages. The first was World War II which saw the European and Asian economies ravaged by war and in ruins. With most of European and Asian gold already in custody in the US (fear of the Hitler and Hirohito’s looting), Asians and Europeans was willing to receive US Credit for post-war reconstruction. Gold was the collateral and the credit extension was in USD. This adoption comes with certain conditions as the Europeans were not all in favour for US to hold a monopoly on the currency for world trade. The conditions were: (a) that USD can be exchangeable for gold at will at a fixed rate. (b) That an IMF be set up and be headed by France for postwar reconstruction funds distribution. (c) There is the additional requirement for two industrial centers to be established respectively in Europe and Asia with two strong regional currencies as counter weight to the USD. As politics goes, Germany and Japan (the WWII adversaries) were chosen by US and thereafter became US puppets. Twenty six years later, with the massive money printing on account of the Vietnam War, US could no longer honor the fixed rate conversion of USD into gold. In 1971 US defaulted on the Bretton Woods Agreement. To preserve the status of USD as a reserve currency, US had to (a) contract credit and money supply by raising interest rates to over 20%, (b) sacrifice domestic manufacturing to generate trade deficits in order to place massive amount of USD into the Treasury of exporting countries, and (c) restricting the global oil trade in USD only. There is also a secret side deal with Saudi Arabia and subsequently US also defaulted. Given an opportunity, I will share this interesting tidbit later. This extension of life by the Petrol Dollar mechanism was the second stage of the USD Hegemony. To a majority of people Henry Kissinger was credited as the architect for the Petrol Dollar but the real founding father of fiat currency, central banking and grand deception was John Law in 1716. I venture to say Henry Kissinger adopted the idea from John Law and even today as oil began to trade in other currencies, US is still trying to extend the USD hegemony by meta-morphing the Petrol Dollar into the Chip Dollar and later AI Dollar. When we understand the logic and methodology behind John Law’s fiat currency and the Mississippi Bubble, we will also have a good grasp of how the global currency war will evolve. I shall digress here to present a few data points on John Law and the Mississippi Bubble before coming back to stage 3 of the USD hegemony and how it must end.

(iii) John Law and the Mississippi Bubble: During the long reign of Louise XIV of France, there were 5 major wars between 1667 and 1714 that nearly bankrupted France. As a consequence, there was a shortage of coins and business and trade significantly slowed down. John Law, a Scottish financier and economist persuaded the Duke of Orleans (who was Regent for the young king Louise XV) to merge Duke of Orléans’Banque Générale Privée ("General Private Bank") with Law’s Mississippi Company. Banque Générale Privée later became Banque Royale (Royal Bank) in 1718, meaning the notes issued by the bank were guaranteed by the king, Louis XV of France. The Mississippi Company was also expanded to hold a monopoly of all overseas trade of France including the French colony in Louisiana, West Indies and China. Shares in the Mississippi Company were offered to the public with payment by instalment. Through exaggerated marketing, the market capitalization of the Mississippi Company quickly grew to the equivalent of US$6.5 trillion in today’s money terms. The value of the initial instalment for the Mississippi Company’s share of 500 grew to 10,000 within 6 months. (Fig. 3)

Whilst the speculation on the value of the Mississippi Company was whipped into a frenzy, paper currency (the Livre) issued by Banque Royale also had no problem in being accepted as money because shares in the Mississippi Company had to be transacted in Livres. Although the official exchange value of the Livre was one pound of silver, it did not matter that Banque Royale never had the sort of silver that can allow a complete exchange of all outstanding Livre. The speculative bubble collapsed after 2 years and is known as the Mississippi Bubble. Though history of the Mississippi Company was short, its refinement through a combination of elements like scarcity is value, a monopoly to protect its use and deception through exaggerated marketing and human greed has availed the fiat USD to last over 50 years.

(iv) Final Stage of the USD Hegemony: The Petrol Dollar was chugging alone just fine until two things happened. First, the development of shale oil which significantly reduces US oil imports and even allow some oil exports in competition with OPEC. The second factor was the rise of China as the world’s largest oil importer. These two factors combined guaranteed the demise of the Petrol Dollar. With the loss of a monopolistic product, US quickly attempted a switch to a complete control of microchips as an alternative. Microchip is a less effective tool than the Oil Trade, Oil trade ranks number 1 in world trade but microchip only ranks 20th in terms of value ($951 billion vs $126 billion). With the launch of Huawei Pro 60 and its 5G Chip in August 2023, the hold on a high end chip monopoly to support the dollar also faced a serious challenge. The entire US establishment went into a shock and it took them 7 months to come up with a Plan B. First the launch of CharGPT to ceate public awareness, then 4 months later a concerted push of the Magnificent 7 stock price. Without the $5.25 trillion increase in value of the Magnificent 7 stocks, how does one convince US debt holders that the increase of $2.85 trillion in Federal Debt in the intervening period is still financially sound. Most people would be skeptical of price of penny stocks in share margin financing but would be totally fooled by the same tactic on a national level. Remember it was only in 2022 that FAANG stock was all the rage and now the flavour of the month became the Magnificent 7. In my thinking, the adoption of AI in the US will be much slower than the internet revolution. The internet was a free for all, everyone is given the same set of tools and people all over the world embraced the new frontier. With AI, the US set up 7 gate keepers which everyone has to be licensed, pay a fee for its use and be under the thumbs of these 7 gate keepers as how to use the AI. Besides after the tech sanctions imposed against countries in BRIC and the Global South, all countries should be extremely weary of adopting unique US technologies. I said in last week’s Blog, we have to discern carefully between the benefits of technology and financial engineering packaged as technology. The Magnificent 7 is a prime setup so far as share value is concern and with it the entire USD denominated asset value. Shall I remind readers again that behind every stock of the Magnificent 7, there are serious challengers from China at only a fraction of the value. Just this week, reports have surfaced that foreign institutions and hedge funds are buying Alibaba again.

Here I am not saying the Magnificent 7 stocks will crash tomorrow. Should you trade, long or short, just keep an eye open on the politics behind. Be warned and be prepared my friends.

2. Watching Brief on US Market Liquidity: An Update of US Reverse Repo Balances which is a good approximation of financial market liquidity indicate a crunch time towards the third week in March 2024. (Fig. 4)

3. Federal Reserve Weekly Trading Losses: Weekly Trading Losses of the Federal Reserve for the week of February 14 2024 was $149 billion. (Fig. 5).

It is trading with negative equity with assets insufficient to cover its liabilities. Cumulatively, its losses since September 2022 exceeded 5 times its capital. These losses are recorded as Deferred Assets and not recognized in the US Government Books.

Proverbs 4:5 Get wisdom! Get understanding! Do not forget, nor turn away from the words of my mouth. 6 Do not forsake her, and she will preserve you; Love her, and she will keep you. 7 Wisdom is the principal thing; Therefore get wisdom. And in all your getting, get understanding. 8 Exalt her, and she will promote you; She will bring you honor, when you embrace her. 9 She will place on your head an ornament of grace; A crown of glory she will deliver to you."

Proverbs 9:10 "The fear of the LORD is the beginning of wisdom, And the knowledge of the Holy One is understanding.