Week ended February 10, 2023, it is Chinese NY Day, the Year of the Dragon, let me first wish everyone a peaceful, healthy and prosperous New Year. For the past 8 days, I was on holidays with my wife to far north Queensland. For most days I did not have internet access by choice and I could only gleam some headline news through BBC and the Sky Channel. As such I considered myself remarkably ill informed of what really happened around the world throughout that period. Just as I returned to my home base in Brisbane, I received a message from a good friend regarding the disparity between economic performance and the stock market indexes around the Globe and I thought I may join the discussion by offering my two cents worth of opinion here.

1. Real GDP Growth Rate and Stock Index Performance: I took the liberty to reproduce a table from my friend that captured Real GDP Growth Rate and Stock Index Performance for various economies around the world. (Fig. 1).

My friend’s thesis was solid GDP growth need not give rise to good stock market performance. Case in point, China and Hong Kong with significant stock market decline against a backdrop of solid GDP growth. That capital flow is far more important in determining stock market performance than real economic considerations. That I totally agree when one takes a snap shot of the two numeric factors over a relatively short time span. Nonetheless, I also agree with Jack Ma’s observations about the Flying Pig. (Fig. 2).

So how do we navigate against extreme turbulent head winds. Where is the updraft coming from? When will the wind direction change? Who is the real Pig? Under what circumstances will a bird turn into a pig? What happens when the underlying currency depreciates faster than the rising stock prices? The Argentinian Main Stock Index (MERVAL) went up by over 360% in 2023 and its single country ETF was the Best Performing Fund globally according to Bloomberg, but all this in the background of a 211.4% inflation. (Fig. 3).

Sadly, the financial market is littered with dead pigs: the South Sea Bubble, The Tulip Mania, The Roaring Twenties, The Japanese Bubble Economy, The Dot Com Bubble, the Subprime Fiasco and Finally the QE to Infinity and Everything Bubble.

2. Life Cycle of A Fiat Currency: A Fiat Currency by definition is a government-issued currency that is not backed by a commodity such as gold. Fiat money gives central banks greater control over the economy because they can control how much money is printed. Most modern paper currencies, such as the U.S. dollar, are fiat currencies. The Average Lifespan of a Fiat Currency is About 35 Years because the enormous powers given to Central Banks tends to corrupt sound monetary policies. Hyperinflation is one of the most common precursors to a fiat currency's collapse. Although the USD is the current world reserve currency and has been for 90 years. In its current form, not backed by Gold, the age of USD as a Fiat Currency is in its 50th year. From the inception of the Federal Reserve, USD has lost 98% of its purchasing power. (Fig. 4).

Within the life span of a Baby Boomer, we have seen some spectacular collapse of Fiat Currencies like the Peruvian Intis (1989), Russian Ruble (1992), Zaire Zaires (1992), Hungry Pengo (1945), Germany Mark (1923), Greece Drachmas 1943). The USD has an atypical long life span based upon US exceptional ability to destabilize Asian and European economies by Proxy Wars and Color Revolutions. Nonetheless US military prowess is under severe strain with the Russian/NATO/Ukraine War, the Israel/Hamas War and its failure to contain the rise of China. For those mathematically inclined, major currency collapse typically works on the law of exponential decline meaning a long gestation period but a sharp and swift demise. Take a look at the Weimar Republic Final Two Years of Hyperinflation and mark time when the Federal Reserve starts QE again sometimes in 2024. (Fig. 5).

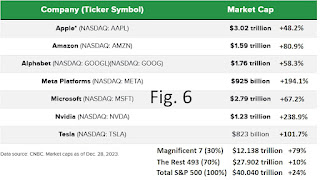

3. Smoke Screens and Mirrors of the Magnificent 7 versus the S&P 493 (500 minus 7): We have discussed before the entire US Stock Market performance was propped up by 7 Tech Stocks which combined rose 79% in 2023. (Fig. 6).

These 7 Stocks accounted for 30% of the entire S&P 500 Market Cap. The rest of the 493 rose by around 10% but due to the 7 stocks, the entire index rose by 24% for 2023. As at market close on Friday, market cap of Tesla was $606.55 billion versus BYD market cap of $71.87 billion (Tesla is more expensive than BYD by a factor of 8.4 times). ByteDance (Parent Co of TikTok) was valued at $268 billion as against Meta of $1.19 trillion ( a factor of 4.44 times), market cap of Amazon was $1.81 trillion vs Alibaba of $180.7 billion (a factor of 10 times). Cost of a US Aircraft Carrier is $13 billion as against China’s $2 billion (a factor of 6.5 times). Prices can be a measurement of something but not necessarily of wealth, value or strength. Using the Buffet Indicator the current US Stock Market to GDP Ratio is 181%. The equivalent measurement for China is only 60%. and for India is 122.8%. The Stock Market in China is just part of the economy but for US, the Stock Market is the economy. To protect the sanctity of the stock market, the last bold facade of the Anglo American, it is not news to find creative reporting of US employment, inflation, GDP and other government statistics and unsubstantiated MSM negative campaign against successful non-US enterprises. Whether a cup is half empty or half full is purely a matter of perspective and interpretation. It takes many data points to establish a clear resolution of a true picture and it also depends on what picture you want to see.

4. Examples of once Mighty Eagles that became Pigs and Crashed: Here I name just two companies that once represented technological and engineering excellence in the US. The first is General Electric. In the Year 2000, it ranked number 2 in terms of global market capitalization. GE had a credit rating even at times higher than US Federal Government. But then the CEO, Jack Welch, found it easier to grow earnings by issuing debt papers at low interest rates and on-lend to consumers via its financial subsidiary GE Credit than the long hard road of industrial innovation. And with that Jack Welch achieved 100 consecutive quarterly earnings growth unmatched by any corporation in the world. But those who live by the sword die by the sword. With the turbulent ebbs and flows of finances in the US, GE crashed in a mountain of debt and in Sep 2020 GE had the same stock price as April 1996, some 24 years earlier. (Fig. 7).

The second company is Boeing. I need not elaborate further on the engineering problems of Boeing. (Fig. 8).

It is sufficient for me to mention that part of Boeing’s problem is the senior executives at Boeing found more satisfaction to invest in stock buy backs than invest funds for product improvement. Are these two companies unique in the American Corporate culture, what do you think? How about Crypto Exchange FTX with the nerd like CEO Bankman-Fried or shared space platform WeWork. Their rise and spectacular fall of these companies has honestly nothing to do with technologies but financial engineering packaged as technology. I venture to say the present bull run in AI stocks is exactly the same financial engineering packaged as technology. One can trace its theatrically staged starting bell and its path of concerted push on stock prices. Here I am not belittling the AI technology, but like Amazon and Tesla, it is a decade of work before one can expect a big financial harvest. (Fig. 9)

5. International Capital Flow: Periodically I table at this Blog international capital flow into and out of US. (Fig. 10) is a chart showing International Capital Flow into and out of US from January 2020 to November 2023.

The November figures are the latest available from the US Treasury Department. As evidenced from the recent Israel/Hamas Conflict in Gaza. The White House Administration is not so much controlled by the US Voters and Congress but by Zionist Capitalist outside of US. US is the largest Debtor in the World and does not control Capital Flow, it is the Capitalist outside of US that dictates the flow into and out of US. In Fig. 10, one will see US took a beating in 2022 that saw $4.5 trillion capital departed from her shores but was a beneficiary in 2023 with influx of $3 trillion. Let’s now narrowly focus on how US Capital affected China and Hong Kong. The Combined US Residents’ Stock holdings in China and Hong Kong at the end of 2022 was US$342.6 billion and as at end November 2023, the value was $300.7 billion. This means a drop in value of US$41.9 billion. When compared with a total Market Cap of the China & HK of US$14.8 trillion, the decline in value was only 0.28%. I won’t call such a sell down earth shattering. In the same corresponding period, China & Hong Kong actually increased their equity holdings in US by $68.3 billion thus giving US a Funds Flow advantage of $110.2 billion in 2023. Whether the direction of Funds Flow was the right choice taken is all dependent upon a difference in perspective of being a momentum trader or a contrarian value investor.

6. So what’s the fuss about a Currency War - In conclusion, a Fiat Currency is a simple Promise. A Promise that one can use the paper it is written on to retire a debt in the Country of Issue. The basis of a Currency is Credit, deriving from the Latin Root Word “Credo” meaning “I Believe”. A Currency War is a “Psychological Warfare” with all the lies, trickery, smoke screens and mirrors that comes with it. The Psychological Tools is “Greed” and “Fear”. Currency and Currency Wars is as old as mankind but sadly even with all the advance education, only one in a million understands how it is played and less than one in a million can overcome the emotions of “Greed” and “Fear”.

Isaiah 41:10 - Fear not, for I am with you; be not dismayed, for I am your God; I will strengthen you, I will help you, I will uphold you with my righteous right hand.

No comments:

Post a Comment